Loans For Self Employed

- 99.9% Satisfied Customers

- Fast Online Decision

- Any Purpose Loans

- Enjoy Tax Benefits

- Secured & Unsecured Loans

I want to borrow

Do you have trouble getting the loan approval because you are self-employed? It happens to most people who are earning their own salary but not regularly. The struggle occurs when you cannot ensure the lender can make the repayments based on your bank statements. In such a scenario, loans for self-employed with bad credit or any credit come into the picture.

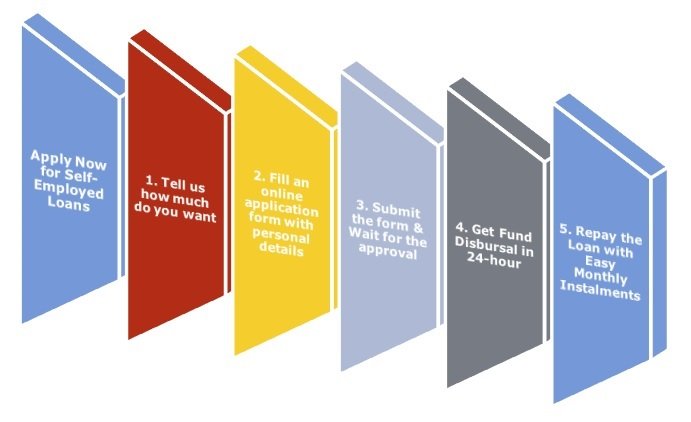

Available on 100% online procedure, these loans suit the best to your current financial needs, especially when you are looking for a start-up. These loans open the doors where you can request some funds to calm down the financial emergencies.

At Figuralloans, we offer such funding for both as long-term and as payday loans for self-employed. The former option seems suitable in filling the financial gap or bringing significant funding to become self-employed.

The option of payday self-employed loans is more appropriate during a financial emergency or you need money urgently. This is a more suitable option primarily because of less involvement of the loan formalities.

Many borrowers used to compare our loan options with those with conventional lenders. There is nothing wrong with it. We are the responsible direct lender in the UK and still encourage you to compare loan deals before choosing the one.

You can get such loans from traditional lenders, but only if you have a good credit score. With poor credit, they usually deny your loan application.

If somehow you get the approval, you may have to pay higher interest rates. Further, suppose you may not make the repayments with higher rates, and then you will be labelled as the individual with bad credit status.

We are ready to assist you despite your less-than-perfect credit score. We responsibly try hard to bring self-employed loans with no credit check. It can be difficult for any lender to promise no credit check, but we can try if:-

Therefore, you need to be very specific in your financial choices. This is where self-employed loans in the UK hold significance for you. These are all-round loans options where the borrowers can apply for either shorter-term or longer-term financial goals, depending upon your needs.

Figuralloans provides you with the opportunity to borrow from £1000 to £100000. These loans are ideal for different classes of self-employed borrowers, such as:-

Freelancers

Sole traders

If you find yourself in any of these categories or related to that, you can borrow funds with us to manage your expenses like unexpected bills or payments, merging debts, boosting cash flow and many more.

Also referred to as Covid Loans, these loans for self-employed people are available on easy norms. Still, you have to fulfil some requirements to get the loan approval.

Before going on to those requirements, we would like to clarify that we provide loans on affordability and encourage our borrowers to apply for that amount. They feel that they can repay easily throughout the loan term.

Do you want to apply for a self-employed grant? Since we are flexible to our lending approach, we consider each application on its merit. As the self-employed person, here are the pre-requisites that you have to fulfil:-

Proof of Income of the last 7 months (the term criteria may differ from one application to another)

Presence of the Guarantor if you opt for funds more than £25000 (interest rates will be lower in this scenario)

Pledging the collateral if you borrow funds above £50000 (available for people with low credit scores too)

These self-employment loans are advantageous in expanding your business wings at the more UK cities or adding infrastructure to your active venture. Still, their sphere has not limited to these purposes. Many financial needs and desires are fulfilled with these personal-cum-business loans, such as:-

Home Improvement: Do you like to have a new home look this Christmas? You can continue to your home improvement plans by getting sufficient financial support from our self-employed loans.

Improving Credit File: These personal loans are suitable for enhancing the credit profile too. We allow the loans on easy instalments, and thus, you can manage them from monthly income and improve your credit performance.

Financial Assistance for Students: Yes, our exclusive deals on self-employment loans also assist students, who want to be self-dependent right from their career. They can manage the repayments from their part-time income.

Self-employed business loans are available on the two doctrines:-

Flexibility

Affordability

TYes, the flexibility in the lending norms paves the way for choosing the loan deal as per the affordability. Based on that, here are the benefits of Covid small business loans for self-employed:-

Soft credit check

As the responsible direct lender in the UK, we conduct our every borrower's mandatory credit check to analyse their capacity and provide the loans on their repaying capacity. However, we do only soft credit check that does not leave any footprint to your credit profile.

Loan Approval on Income Capacity

We bring the loan approval purely on your earning capacity. We are not interested in approving your loan application on your credit score status or with the presence of guarantor or not. Show us your income proofs and get the desired amount.

No Upfront Charges

No more surprises or no upfront charges when you apply for our any of the loan deals. The self-employed loans include only the interest rates and the principal amount to pay in the form of monthly instalments.

Fee-Free Expert Advice

If you have any confusion on the self-employed loan or its features, do not hesitate to call our financial experts. They are always ready to guide you without asking for any fees.

The self-employed bounce back loan scheme is for those businesses in the UK, which have been affected by Covid-19 and struggling to continue their cash flow. They can access a few funds to bridge their funding gap due to that pandemic's aftermaths.

These are the Government loans for self-employed helping business owners, especially those running the start-up companies.

There will be some rules and regulations to follow for those looking to apply for bounce back loans. In case you find it complicated to approach the government's bounce back loan scheme, you can approach Figuralloans, offering loans on flexible terms.

The significant benefit with us is that you can apply for self-employed bounce back loan without a business account. We provide a doorstep cash loan facility to apply by sending a loan application through a mobile text.

Yes, we do accept their applications. Our flexible lending policies allow the approval on the loans for self-employed with poor credit from direct lenders. We are not much interested in knowing the borrowers' credit histories. Instead, we want to know their financial capacity to repay the loan throughout the term.

We follow the online procedures to provide loans for self-employed with good credit or low credit score. Moreover, we have further convenient for them to get approval on self-employed loans for bad credit with no guarantor.

The interest rates may be on the higher side, but the approval is there despite applying for self-employed loans with no guarantor.

Figuralloans is committed to offering you the best loan products to solve any financial issue. For the self-employed people, we have exclusive deals on self-employed loans in the UK. Thus, do not think a lot and start applying for these business bounce back loans.

CAN I OBTAIN PERSONAL LAON WITH SELF EMPLOYMENT?

IS THERE ANY POSSIBILITY OF SELF EMPLOYED LOANS WITH NO CREDIT CHECK?

CAN I APPLY FOR SELF EMPLOYED LOANS WITH NO INCOME PROOF?

WHAT ARE THE PROSPECTS OF SELF EMPLOYED LOANS FOR BAD CREDIT PEOPLE?

ARE PAYDAY LOANS FOR SELF-EMPLOYED IN THE UK AVAILABLE?

SHOULD I APPLY FOR SECURED OR UNSECURED SELF EMPLOYED LOANS?