Personal loans can be used for almost any purpose. This makes them perfect for every life situation. Many lenders offer online applications that take just minutes to complete. You can often get approved the same day without mountains of paperwork. Some people even see money in their accounts within 24 hours of applying.

Personal loans come with clear terms from the start. You’ll know exactly how much each payment will be and your end payment date. This clarity helps with planning your budget months or even years ahead. The fixed end date means you won’t face endless debt like with credit cards. More residents choose personal loans each year for funding home fixes, handling medical bills, or merging other debts.

What are Personal Loans?

A personal loan is a loan where you get money from a lender that you pay back over time. You receive a lump sum directly into your account when you take out a personal loan. You’ll then repay this amount through regular monthly payments.

The repayment period is between one and seven years. You can choose a short or long term. The short-term loans come with high rates, whereas in the long term, you will have some concession on rates.

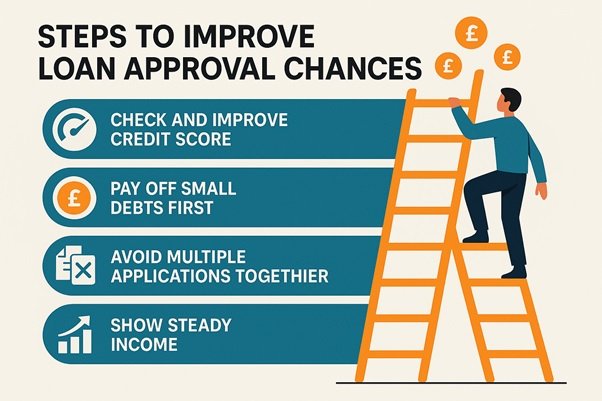

Your credit score plays a huge role, and better scores unlock lower interest rates and save you money. The lenders check your credit history carefully before approving your application.

- Loan amounts from £1,000 to £25,000

- Application decisions often come within 24-48 hours

- Early repayment may trigger extra fees

- Some lenders offer payment holidays during tough times

You can get personal loans in the UK for big expenses like home improvements, debt consolidation, or unexpected bills. They give you clear payment schedules and help avoid the high interest of credit cards.

How Does a Personal Loan Work?

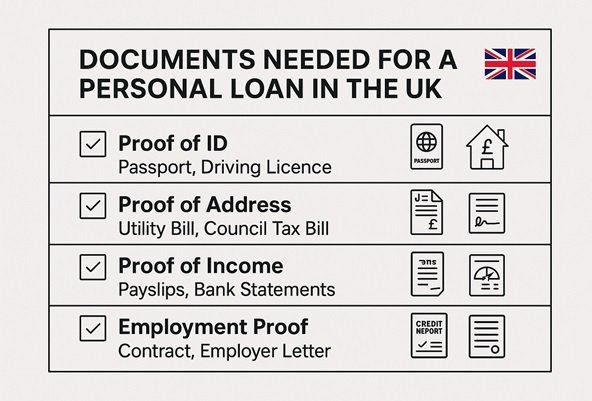

A personal loan starts with filling out an application. You can do this online or by visiting your local bank branch. The form asks for basic details about your financial situation and job history.

The lenders check your credit score and verify your income once you submit your application. They want to make sure you can pay back what you borrow. You have to know your credit score to be sure if you can get low interest rate personal loans.

You’ll get an offer if the lender is comfortable working with you. After approval, you will get the amount within a week. You need to make a payment that covers both the amount borrowed and the interest rates for repayment.

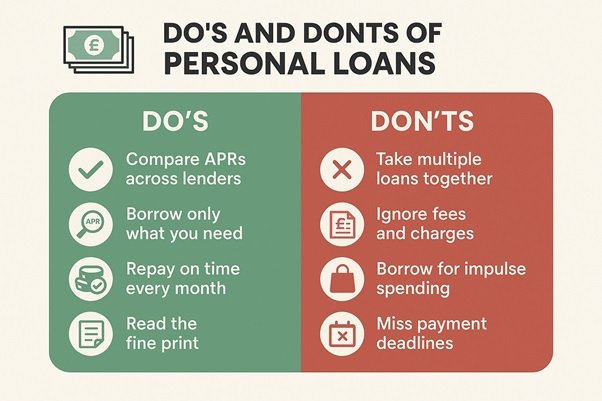

You’ll face late fees and your credit score will drop if you miss a payment. This makes it harder to get the best personal loans in the future when you might really need them.

- Your debt-to-income ratio affects approval chances

- Some lenders offer rate discounts for autopay setup

- Reading the fine print helps avoid surprise charges

- Most loans have no penalty for paying extra

- Shopping around with different lenders often saves money

You can get personal loans when you need a specific amount for a planned expense. The clear structure helps you avoid endless debt cycles.

| Average Personal Loan Interest Rates in the UK (2025) | |||

| Credit Score Level | Score Range (UK) | Typical APR % | Likely Approval Odds |

| Excellent | 750+ | 6% – 8% | Very High |

| Good | 700–749 | 9% – 12% | High |

| Fair | 650–699 | 13% – 18% | Medium |

| Poor | 550–649 | 20% – 30% | Low |

| Very Poor | Below 550 | 35%+ | Very Low |

Types of Personal Loans

You need to know about the different personal loan types to choose wisely. Here are some of them:

Secured Loans

These loans require something valuable as backup. Your home, car, or savings might serve as collateral. The lender can take this asset if you stop making payments. You will get loans with low interest rates and higher borrowing limits.

Unsecured Loans

Most unsecured personal loans don’t need any collateral. The lender gives loans based on your credit history and income. These loans work well for people who don’t own big assets. They come with higher interest rates due to the increased risk for lenders.

Fixed-Rate Loans

Your interest rate will be the same throughout the loan’s life span. Many borrowers prefer this steady approach. You’ll know exactly how much to set aside each month until the loan ends.

Variable-Rate Loans

The interest on these loans can go up or down. They often start with lower rates than fixed options. But payments might increase if market rates rise. These work best for small personal loans with short terms where rate changes have less impact.

Debt Consolidation Loans

The debt consolidation loan can help you merge multiple debts into one simple payment. This option often saves money through lower overall interest. It also reduces stress from managing multiple due dates.

Guarantor Loans

A guarantor can help when you have bad credit. This person promises to pay if you can’t. Many people seeking personal loans with no credit check end up with this option instead. The guarantor must trust you’ll make payments on time.

These types help match the right loan to your situation. You can take time to compare options before signing anything.

| Types of Personal Loans in the UK | ||||

| Loan Type | Secured? | Interest Rate Range (Typical) | Best For | Risk Level |

| Unsecured Loan | No | 6% – 25% APR | General use, no collateral needed | Medium |

| Secured Loan | Yes | 3% – 10% APR | Large sums, lower rates | High (asset at risk) |

| Fixed-Rate Loan | No | Fixed 6% – 20% APR | Predictable monthly payments | Medium |

| Variable-Rate Loan | No | Starts lower, can rise | Short-term borrowing | Medium-High |

| Debt Consolidation Loan | No | 7% – 18% APR | Combine multiple debts | Medium |

| Guarantor Loan | No (needs guarantor) | 20% – 50% APR | Borrowers with poor credit history | High |

Main Features of Personal Loans

Personal loans offer a flexible way to borrow money for almost any need. You can also get cheap personal loans by understanding your credit score and situation.

- No collateral is needed for most personal loans. This makes them accessible to renters and those without major assets. The lender bases approval on your income and credit history.

- Clear end date with fixed monthly payments. You will know the time when you will be out of debt.

- Interest rates range between 36% and 3% based on credit score. Individuals who are rated better in credit get to save thousands in interest.

- The minimum loan is as little as £1,000, and the maximum is £50,000 for the best customers. This wide range fits both small needs and major expenses.

- This offers quick funding after approval, which is within 24 hours. This speed helps when facing time-sensitive costs or challenges.

- Fixed terms between one and seven years let you balance payment size against total cost. A personal loans calculator helps show how changing the term affects your monthly budget.

- No limits on how you use the money. This freedom lets you handle multiple needs with one loan.

These characteristics make personal loans a good option for their planned expenses when you require a specific amount. They are efficient when there is a clear plan on how to utilise and repay the funds.

What Are the Uses of Personal Loans?

Personal loans have fixed terms and clear payment plans. Here’s how people use these loans.

Debt Clean-up

You can pay off high-interest credit cards with a single loan. Many people seeking low APR personal loans use them to tackle existing debt. The lower rate saves money while the fixed term ensures an end date.

Home Renovation

Personal loans help fund these projects without tapping home equity. They don’t put your house at risk. The quick approval means your project can start sooner.

Health Costs

Personal loans can help when insurance doesn’t cover all your medical bills. They help with planned procedures or surprise health issues. The fixed payments make budgeting for recovery easier. Many medical offices even suggest loan options for patients.

Life Events

You can get these loans for weddings, big trips, and family reunions. Personal loans let you enjoy these moments without draining savings. You can focus on making memories rather than money worries.

Big Purchases

Personal loans offer better rates than store credit cards. The money gets credited to your account so you can shop for the best price anywhere.

Personal Loans vs Other Loan Types

Personal loans stand out in some ways, while other options work better in certain cases.

Personal Loans vs Credit Cards

Credit cards let you borrow again and again up to your limit. You pay interest only on what you use, not the full amount. Personal loans give you one lump sum with a set payback plan. They offer lower interest rates for large purchases. The cards work better for small and ongoing expenses, while loans suit big and one-time costs.

Personal Loans vs Payday Loans

Payday loans provide quick cash until your next paycheck arrives. They come with extremely high fees that can equal 400% APR. Personal loans take longer to get but charge much lower rates. The payment time stretches over months or years, not weeks.

Personal Loans vs Lines of Credit

Lines of credit work like reusable personal loans. You can borrow, repay, and borrow again within your limit. The interest applies only to the amount you take, not the whole limit. Personal loans provide the full amount upfront with no second chances. Lines are for ongoing projects, while loans work for fixed expenses.

Conclusion

Personal loans fill the gap between the inflexible, purpose-oriented loans and the more expensive quick-cash loans. They facilitate the resolution of money issues without causing more issues in the future. It is also possible to take personal loans for bad credit with a slightly higher rate.

You only need to go through the agreement to prevent being caught up in the unpleasant surprises. You can compare the offers of multiple lenders, and this usually saves hundreds or even thousands in interest throughout the life of the loan.