What do you do when you fall short of cash? You either call up your friend or seek an instant personal loan. The latter one is the quickest and most convenient way to get money when you need it. You may use a personal loan to cover an urgent health requirement or achieve a long-term goal like buying a car. It helps you meet needs without staking up collateral or depending on savings.

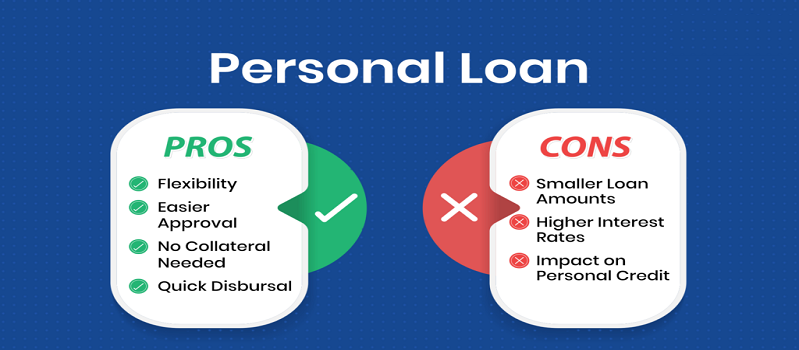

However, at the same time, it shares competitive interest rates. It may make the loan costlier. You may be thinking- Is it possible to get an affordable personal loan? Let’s read ahead to know in detail. The blog lists the basics and the pros and cons of a personal loan. It may also assist you in choosing the right loan.

|

What can you use a personal loan for? |

Any small and long-term purpose, like fetching urgent medicines or buying a vehicle |

|

Are personal loans secured or unsecured? |

Personal loans are mostly unsecured in nature, but you may get secured loans, too. |

|

How much can you get? |

£1000-£25000 |

|

How long can you borrow a personal loan for? |

12 months- 5 years |

What are personal loans?

Personal loans are an unsecured financial facility that helps you meet any short and long-term goals. You borrow a fixed amount and pay it in equal monthly or weekly instalments over the loan tenure.

Since you don’t have to pledge an asset, the approval is based on your credit score, income and repayment track record. Individuals with a good credit score and consistent income may get instant loan approval. The stronger your finances, the better terms you may get.

How does the Personal loan market look for individuals?

Interest rates and pricing

- An average interest rate on a 5000-pound personal loan is 10.96% APR, and on a 1000-pound loan is 6.95% APR

- Individuals with excellent credit scores may get personal loans at low interest rates of 5.8% and 8.9% APR. However, individuals with fair credit may get personal loans at 25-29% APR.

- Consumer Credit grew in 2025, with net borrowing remaining as strong as ever. Around 7% individuals have unsecured personal loan debt. 13% individuals are considering taking one in 12 months.

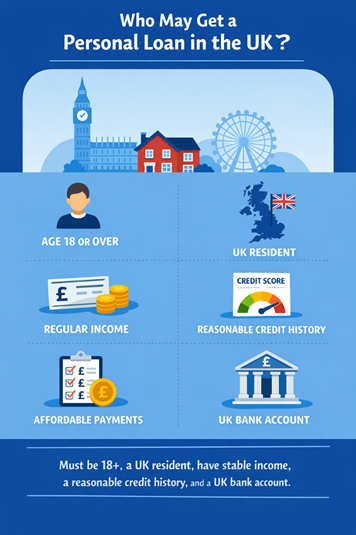

Who may get a personal loan in the UK?

Below is a precise and practical breakdown of who may get a personal loan in the UK, based on current (2025) lending standards.

- Age requirement: Individuals should be aged 18-21, with a maximum age of 75, to get a loan.

- Residency status: Must be a UK citizen with 2-3 years of residential address history

- Income: Must hold a regular income as a part-time/full-time/self-employed/ pension

- Credit score: Individuals with an excellent credit score (1121-1250) may get low interest rates.

- Stable employment: 3-6 months with current employer

- Bank account: A reliable bank account with a direct debit facility

What are the Pros of a personal loan?

Pros of personal loans

Predictable payments and budgeting

Personal loans come with fixed interest rates. It means that the monthly repayment amount remains the same throughout the loan term. You can budget easily by setting direct debits.

|

Feature |

Representative Example |

|

Loan type |

Unsecured personal loan |

|

Loan amount |

£10,000 |

|

Loan term |

5 years (60 months) |

|

Representative APR |

6.9% APR (fixed) |

|

Interest rate |

6.9% per annum (fixed) |

|

Monthly repayment |

£197.45 |

|

Total amount repayable |

£11,847.00 |

|

Total interest charged |

£1,847.00 |

Lower interest than credit cards

Personal loans are cheaper than alternatives like credit cards. The APR on credit cards is 24.66% in 2026, while you may get a personal loan at 6-10% APR. Individuals with excellent credit scores may further get better interest rates on personal loans. Moreover, the ability to budget that credit card lacks makes unsecured personal loans a better option.

Flexible usage

You can use the loan for any particular reason, like:

- Funeral

- Debt consolidation

- Car purchase (used or new)

- Financing a wedding (venue, catering, or dress)

- Health emergency

- Home repairs (bathroom, kitchen, or lawn)

- Car repairs

- Bill payments (utility or credit card payments)

Helps improve credit score

A well-managed personal loan may help you improve your credit score. Consistent payment help build a positive payment history and improves the credit mix. Here is how to handle a personal loan to boost your credit score:

- Borrow only what you can afford to repay

- Use a loan calculator to understand and choose the right repayment term

- Set direct debits for consistent payments

- Avoid taking a massive or high-interest loan before paying off a personal loan.

- Overpay a personal loan to save interest and boost your credit score.

What are the Cons of a personal loan?

Cons of a personal loan

1. High interest costs

Interest charges can be more expensive than a secured loan. Thus, a long repayment tenure may prove costly from an interest perspective. You pay more in total than.

What to do?

- Compare interest rates by pre-qualifying, especially for unsecured personal loans

- Pay some debts and update your credit report before applying for a loan

- Analyse the possibility of applying with a guarantor

2. Fees and penalties

Apart from interest, you may face costs like- loan origination fee, closure fee and administrative charges. You don’t pay them differently, but as part of the monthly instalments. However, you may be charged a penalty if you skip a payment.

Alternatively, if you pre-pay without asking the creditor, you may encounter a prepayment penalty. It may thus make your loan costly. Analyse and compare the costs before borrowing a personal loan.

What to do?

Here is what you must compare before getting a personal loan:

APR- Annual Percentage Rate-

- It is the total cost of the loan.

- Choose the one with the lowest percentage.

- APR on loans without collateral is lower than that of unsecured loan

3. Total amount repayable

- It is the total cost of the loan that you pay in a year

- (principal+interest+loan fees)

4. Monthly repayments

Analyse how much you need to pay monthly on a loan.

5. Risk of over-borrowing

Easy access to a large sum of money makes one borrow more than necessary. Thus, one pays more interest overall. It may affect the ability to meet essentials.

What to do?

- Always analyse your needs and check savings

- Borrow only what your savings cannot cover

- Compare the interest and the total repayable amount

- Check additional and unnecessary fees to pay

5. Affects future borrowing aspects

Applying for multiple applications at a time may affect your credit approval chances. It casts a negative impression, and you may be rejected for a loan.

What to do?

- Always pre-qualify before applying

- Use a loan calculator to understand your borrowing goal.

When to avoid a personal loan?

- Borrowing money for discretionary expenses like buying luxury goods without a spending plan

- Using it to cover income shortfalls with no hope of improvement in earnings

- Replacing one loan with another without checking underlying budgeting issues.

Bottom line

Thus, a personal loan may help you boost your credit rating if used well. However, taking one unnecessary or missing payment may affect the credit score. Moreover, it may impact your chances of getting a loan in the future. Identify and compare aspects like APR, interest rates, and total repayment costs while choosing a loan.