Making enough money is tough for UK freelancers and contractors. You don’t get a regular paycheck. Your income tends to go up and down. Handling your cash flow smartly really matters.

You want to make the most of every pound that comes in. Then save some for when business is slower. Making money is great, but you have to plan ahead to keep some!

It’s not easy, though. Freelance work is uneven for most people. You search around constantly looking for your next gig. And even loyal clients might pause projects suddenly. You can go from flooded to dried up pretty fast.

There are approximately 4.39 million freelancers in the UK, according to Statista.

So, you have to become extra savvy with the financial side of solo work. From prompt invoicing to neat expense tracking and steady saving, it takes effort to manage income flows. But getting your system sorted makes riding out dips much less stressful.

1. Diversify Income Sources

You will have to offer more than one service. Don’t rely on just one area of expertise. Broaden your skill set so you can take on different types of projects. Seek freelance gigs across multiple industries. If one sector sees a slowdown, you still have other active income streams. Make products that earn with no extra work. Things like:

- ebooks

- online courses

- membership sites

The big idea is to have multiple money streams. Don’t put all your eggs in one place. UK freelancers should give different services, help varied clients, and build an income that runs itself. This enables you to get money even when some work dries up.

2. Regular Invoicing

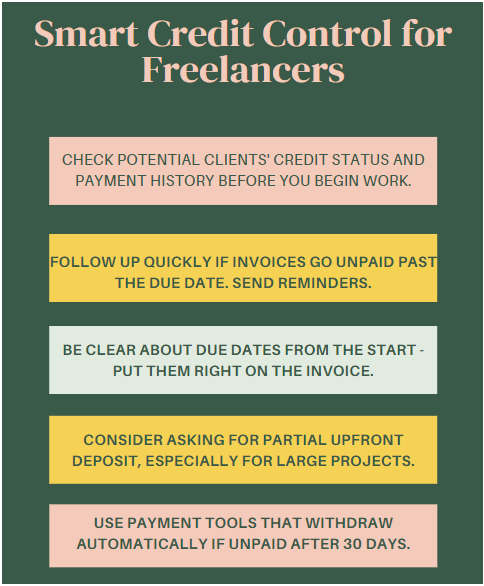

You must send the invoice as soon as you finish a client gig. Don’t let time pass. Bill them right away while everything’s fresh.

Use software that sends automatic reminders. This way, you spend less time chasing payments. Options let you schedule reminders to go out at set times.

Also, inform every client upfront: when and how do they pay you? Be clear from the very start. Talk out things like:

- Number of days they get after you invoice

- Your preferred payment methods

- Any late fees if they drag past the deadline

It’ll make life much easier if there are no surprises or confusion about money later on!

Having a solid system for invoicing and telling customers the score helps UK contractors get paid on time. Handling that cash flow smartly lets you put time toward other clients rather than payment chasing.

3. Build an Emergency Fund

As a rule of thumb, freelancers should set aside 30% of every paycheck as savings.

Put some money aside whenever you get paid. Make it a habit. Aim to save enough to cover 3-6 months of normal costs if work slows down:

- Rent and bills

- Basic food

- Transportation

- Insurance

That gives you a cushion in case you hit a patch with no contracts. If you really need money in a pinch, you can also ask about loans. For example, some loans for self-employed with bad credit might work if you keep good records that show regular income coming in or you have something to offer as collateral.

Just try not to use loans too much – savings are safer if you can build them. Put your emergency money in an account that earns good interest. That way, it grows a bit faster while waiting for an urgent situation.

4. Use Technology

Tech tools can help UK freelancers and contractors boost their cash flow. Use quick payment systems to get money faster. Ones like PayPal and Stripe deposit funds straight into your linked bank account. This gets client dollars to you quicker than old-school checks and invoices.

Track what you spend via handy apps. Have costs under control by seeing where the money goes. Helpful trackers for this include:

- Expensify

- Receipt Bank

- Spendee

Manage your books in the cloud. Web-based accounting software keeps all your records neatly online. Popular choices are FreshBooks and Xero for their simple interfaces.

By pulling key tasks into slick new tools and apps, you save time while keeping tighter control of your freelance finances.

5. Offer Early Payment Discounts

One smart way freelancers can encourage faster payment is to offer a small early payment discount. Give clients a discount of 1-2% if they pay their bill quickly after you send the invoice. Even a tiny price break can be enough to motivate them to pay promptly.

Benefits for you include:

- Get money in hand sooner

- Improve cash flow

- Streamline your invoicing system

Benefits for the client:

- Save a percent on your services

- Incentive to prioritise paying your invoice

It’s a win-win. You get faster access to money owed, while customers feel good about snagging a deal. Offering an early payment discount is an easy way you can speed up client payments, which is critical for strong cash flow. It builds goodwill and stronger relationships with the customers you depend on for business.

6. Regularly Assess Expenses

Look at what you spend each month on your freelance operation. Track things like:

- Equipment

- Software

- Marketing fees

- Office rent

Figure out what’s needed versus nice-to-have. Cut any fat that’s draining your accounts without much purpose. Also, negotiate vendor rates and service plans. See if you can scale back or find a better deal on big recurring costs. Every little bit of savings helps.

If you hope to ever use your skills to launch a business, you’ll need some capital. An option to get startup funding is a business loan with guaranteed approval, which looks mostly at your experience rather than just a credit check. Saving up also helps, of course.

Trimming unnecessary outflows while making the most of your income lets you improve your financial position. Assess regularly and tighten spending to maximise what you net.

Conclusion

Managing your cash well takes work but pays off for UK contractors! It lets you sleep better and focus on the projects you love. Make invoicing and paying bills simple routines. Save what you can for slow times.

Use handy tools to track money going out versus coming in and run the numbers often to make smart decisions. Putting these cash flow tips into practice can make your freelance experience so much smoother. Steady planning means you’ll be ready for whatever comes your way.