Partners who plan out money aims united do better on reaching them. Harmony replaces money fights. Less stress exists. Trust and teamwork grow when you budget, discuss financial moves, and progress towards goals jointly.

Setting both shared and individual money goals. Making a spending plan with savings. Investing early for later years. Getting insurance and legal papers. Preparing for big life moments up ahead. Regularly checking in on finances.

Follow these and money works for you not against you. Financial burdens lift. New options open up. Confidence rises in your partnership and money situation. Read on to start gaining peace and prosperity together financial wise.

Planning for Major Life Events

Over time, couples experience great events like weddings, kids, and buying a home. Prepare moneywise by:

1. Setting Savings Targets

Figure the cost of:

- A wedding

- Daycare/schooling per child

- College if in your plans

Then set a timeline aims. Put away monthly even small sums. It builds over the years.

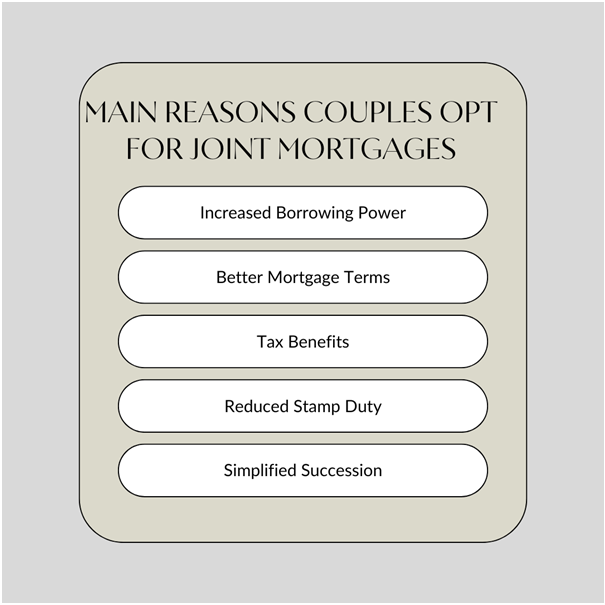

2. Home Buying

If self-employed or own a business, go for special UK loans to buy property even with bad credit or unstable income. These self employed bad credit loans need bank statements proving regular monies. Offer an asset like machinery as collateral. Cosigning with a partner also works. These loans make home ownership possible.

3. Get Insurance

Protect the health, life, income and possessions from the unexpected:

- Life – Goes to partner if you pass

- Health – For illnesses and injuries

- Home – Covers damages

4. Legal Readiness

Have wills saying what belongs to each other if one dies. Select also who makes medical and money decisions if ever disabled.

Setting Financial Goals Together

When you and your partner set money goals together, it helps your future. Cover both short and long:

- Short-term – What you want in 1-3 years. Like a trip, an appliance, or save for a house.

- Long-range – Goals for 10+ years down the road. As in retirement, college for kids.

Also, decide if an aim is for one of you or both. Shared aims unite you, such as saving up to buy a place to live.

Your aims should be:

- Clear – Know exactly what you want to achieve

- Real – Within reach if you budget and save

As a couple, it’s easier to apply for loans for big things like a home, retirement, or vacations if you lack large savings. You can qualify for a low-interest £3000 loan over 3 years. This makes major purchases possible when you both commit to small payments monthly.

The key is open talk about what you want short and long-term. Have realistic shared money aims. And use loans wisely so aims become reality. This plan as a couple leads to money success.

Creating a Joint Budget

A budget helps you reach goals. It works when couples set the plan mutually.

Only 40% of couples distribute their household bills based on their respective incomes, while over half (51%) opt for a 50/50 split. This helps to have a stable finances.

Categorize Expenses

- Fixed – Set amounts each month like rent.

- Changing – Bills that differ per month like electricity.

Decide together how to use income on:

- Needs – Home, utilities, transport

- Wants – Eating out, hobbies, vacations, gifts

- Savings – For goals, security.

An emergency stash covers surprise expenses like car repair. Aim to save 3 months of fixed costs. Apps make it simple to track spending in real time. Many UK options exist. Select one you both will use daily.

Tips for Making the Plan Work:

- Talk over all costs monthly

- Compromise on spending differences

- Adapt plan when needed

A shared budget aligns you with saving and meeting life expenses. Adjust to stay on track to your mutual money goals. Review routinely and jointly decide on changes.

Investing for the Future

Investing money helps it grow for when you eventually do not work. There are options like:

- Stocks – Buying part of a company

- Bonds – Loan money to a company or government

- Mutual funds – A mixed group of stocks and bonds

Talk over your ease with risks. Stocks can earn more long term but swing up and down. Bonds pay steadier but lower returns. Blending them spreads risk. Retirement accounts in the UK offer tax perks when you save for later:

- ISA – Save up to £20k yearly

- Pension – Access at age 55, transferrable

Open these jointly if your aims allow. Contribute what is doable per your budget to build retirement money. To further spread risk, invest money into different industries – tech, energy, finance. This diversity keeps your savings safer if sectors dip up and down.

Discuss regularly where to invest savings for growth. Learn options together. With shared decisions on risks and accounts, investing powers your future financial life. Start early even if it is small. Time helps money grow.

Regular Financial Check-ins

Meet about money plans monthly or every three months. Review budgets, savings, investments and debts. Then realign if needed.

Revisit:

- Income and expenses the past period

- If you met savings targets

- If investments remain right for joint goals

- Any changes needed in spending

Be open about money behaviour and habits. Talk in a calm way even if facing an issue like new credit card debt. No blaming each other – solve it cooperatively.

Celebrate achievements like:

- Reaching an aim of saving up for a trip

- Paying off a student loan

- Adding more to retirement funds

Marking progress with a dinner out or trip highlights all you gain using a budget and saving wisely.

Meeting routinely keeps your financial framework strong. Adjust budgets if incomes or costs shift. Rebalance investments if markets swing. Continue contributing steadily to savings and debt repayment.

Working as a team around money solidifies relationships. Stay the course to financial freedom.

Conclusion

The time to take control of finances together is now the course. When challenges hit like job loss or major home repair, support each other in solving it rather than play blame. Review insurance to reduce such risks going forward.

Applying these tips leads to less financial stress, greater savings, and more options. Money strengths your relationship when handled as a team effort. Less disagreement happens. You feel pride and unity on reaching goals like buying a home or taking a dream vacation.

So start today. Build frameworks, habits and financial knowledge side-by-side around spending, saving and investing. The compounded benefits over decades are huge. Lead a moneywise life jointly for prosperity now and later on.