You have good products. You have the best marketing strategy in place. The company holds experts who graduated from top universities. What’s stopping you from getting the right investors? Most experts translate the reason as the gender gap. The preference of male entrepreneurs over women is not new.

However, things have changed now slightly. This new-born awareness is making top investors recognise women-led startups. If you are a women entrepreneur seeking inspiring investors for your startup, the blog may help. It is a guide to finding a partner that values your goals equally as you. That’s where you grow. Let’s analyse the small guide to finding and getting the right investors for your business.

What challenges do women entrepreneursface while finding investors?

The most common reason women struggle to find the right investor is- a male-dominated society. In this, male investors prefer male entrepreneurs. This bias broadens when it comes to declaring equal opportunities. Additionally, women entrepreneurs face tough questioning and rigorous scrutiny during pitching. It makes it difficult for them to convince and grab funding. Here are other challenges that women entrepreneurs face while finding investors:

1) Low investor count in less-capital-intensive industry

It is challenging for a women business owner to tap into growing and leading industries. The existing competition from top firms dominates such industries. Thus, most women operate within less profitable and low competitive industries. It grants them an opportunity to work on their dreams and start a company.

However, finding an investor in a low-capital-intensive industry is tough. No one wants to invest in a business that does not share present or future demand. Moreover, less capital means low equity percentages. It simply turns off the investor’s interest.

2) Funders prioritise masculine traits for success

Most investors equate qualities like- decision-making, leadership, perseverance and risk-taking with masculine traits. They expect women entrepreneurs to lack the basic traits required for business success. This bias or belief prevents them from investing in a woman-operating startup. Opposed to this, most women business holders host these skills in the best sense. It is just about getting the right platform and support to deliver.

3) Nature of industry women operate in

Female entrepreneurs prefer more women-based niches. It could be fashion, retail, and wellbeing. Most investors don’t simply want to invest in such industries. However, you may still find some funding help from traditional banks and loans.

Yes, you may get a small business loan for women entrepreneurs with some best loan providers. Business loans help overcome tough challenges at work. These eliminate industry and gender barriers and prioritise affordability. Share the potential to reveal the potential to repay the amount. You may get one instantly with the financial documents and revenue proofs.

It catalyses the loan approval process. You can tap it for any short and medium-term business needs. However, you cannot depend simply on business loans for growth. You would need a consistent funding source. For that, you need investors. Let’s understand the tricks to find better investors for your firm.

5 Strategies to Find the Right Investors as WomenEntrepreneurs

Female-led businesses often hold the right potential and vision. They are not just profit-oriented. Instead, prioritise the wellbeing of their targeted customers. The “empathic” trait sets them apart from male-based businesses. It is the most important aspect to appeal to and retain customers. You can use this in your pitch and the business tagline. Here are some strategies to find the right investors:

1. Explore the leading industry and competition

Finding the right industry is important. You may struggle to compete with existing brands. However, you can stand out. Explore some unique business ideas for women entrepreneurs. It could be different from fashion and apparel.

For example, you can start a virtual event planning business. You would not find much competition here. You might not have heard about it. Things like that exist. Most companies invest in the best virtual events. It could be to train employees or hold an interview with an industry expert. You can invest your creativity to nail the industry. Similarly, you may spot some leading industries. Explore the skills required and growth. Invest accordingly.

2. Build a business emergency fund

Getting instant capital for your products is challenging. Moreover, getting the right investor may take time. Thus, invest in the emergency fund for business needs. Start saving before making your first pitch. You can rationalise savings by downsizing on the items you need. For example- avoid buying up office if just starting.

You can begin operations from home initially. Similarly, save money on transportation by sharing cabs. You can save in the emergency fund accordingly. Don’t use it unless important. It may help you with critical aspects like experimentation and creating the best business plan.

3. Explore only niche-based investors (preferably women)

You may spot some famous investors that you want to deal with. However, niching out is important. A person sharing the least knowledge about the industry won’t buy. Moreover, he may not help you grow. Thus, explore only niche-based investors and prepare a list. You can filter out the women investors. Schedule a meeting with them first. It is where you share the most chance to grab the deal!

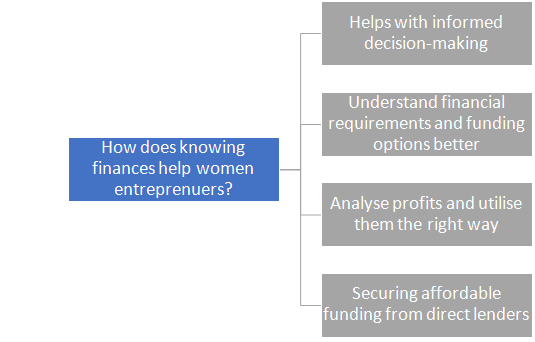

4. Know your numbers and accounts better

According to Women Code Report 2024, “there is an increased need for women to know their technological and financial needs.” As British Business Bank stresses ensuring the equality of finance and technological tools set up for women entrepreneurs. It helps adopt internal practices for women to access finance to begin and grow their businesses.

Thus, understanding finances is important to rule out the failure possibilities. Instead, it grants you confidence about knowing the numbers. You can explain it well to the respective investors. They want to know the strategy behind achieving the specific turnover goal. If not detailed, give a glimpse.

Moreover, knowing your assets, liabilities, and cash reserves helps during business loans. You may need one at any business phase. The ease of getting one makes it one of the best ways to fund the needs. However, when you know what you need, you get one instantly. The financial knowledge may help you understand the loan provider’s requirements and plan. For example- you can understand the amount you may get against the specific asset placed as collateral.

Moreover, experts at Figuralloans may help you decode the rest. They share the expertise of helping women entrepreneurs get the needed funds. You can rely on the firm for transparent and affordable lending. You can get clear guidance on repayments and other liabilities. Thus, it catalyses the loan approval process.

5. Find someone who shares your passion

After niching out, check whether your passion clicks with someone. It could be the best deal. For example- if you want to bring about a change in pet grooming, connect with someone who was a part of the pet care business. You may spot many. It increases the chances of getting desirable funds.

Moreover, you share the probability of continuing the deal for a long. What could be better than having a stable investor? Explore LinkedIn profiles.

Follow related individuals and know their thoughts. It could help you connect on better terms later. Knowing about your to-be investor is always a plus point. You can even relate one of their initiatives to yours(if you have any). Don’t brag about things. Just stay true to numbers and your goal.

Bottom line

These are some of the best ways to get better investors as a woman. Understand your business needs and stakes. Check which industries would turn out beneficial for you. Factor in the bias and the competition. Additionally, research and gain continuously about financials and ways to improve one. Ensuring better financial knowledge helps fetch good investors and business loans. It helps you ensure more clarity on your revenue numbers. This is something an investor looks for.