What if you can get cheap interest rates despite a bad credit rating? Yes, you may get one by providing one of your assets as collateral for the loan. Now, you must be thinking- what do you mean by collateral? It is an additional security in the form of property, belongings, or a car that one provides on a secured loan.

The asset helps individuals with a bad credit history qualify for better interest rates and terms. A loan backed by collateral helps one save money on interest rates, total loan costs and monthly instalments. Eventually, it helps you meet your needs within budget. Let’s understand collateral and its types with examples.

What do you mean by collateral?

Collateral refers to a personal or business asset that an individual provides to secure a loan. The asset helps the borrower with a bad credit score qualify for affordable terms. In turn, it also eliminates the risk for the loan provider regarding the loan default.

Should the borrower fail to repay the loan, the creditor may rightfully claim the asset. The size of the collateral required usually depends on aspects like- amount required, credit score, and repayment ability.

It is worth noting that only secured loans require collateral. If you lack assets, check out unsecured loans. It may help you get cash assistance without sacrificing any assets. However, the terms stay a little competitive in that case.

What are the main types of collateral for loans in the UK?

Different loan providers have unique terms regarding analysing the collateral requirements. They calculate the loan-to-value ratio before providing the loan. The ratio helps determine the value of collateral placed from a future perspective.

For example, if you provide your residential condo as collateral on a home renovation loan, you may get 80% of the asset’s value as the loan amount. It is because the price of a renovated property eventually increases over the years.

Also, the collateral you provide depends on the loan type. For example, if seeking a car loan, then the car acts as collateral. Alternatively, for home improvement, the residential property acts as security for the loan.

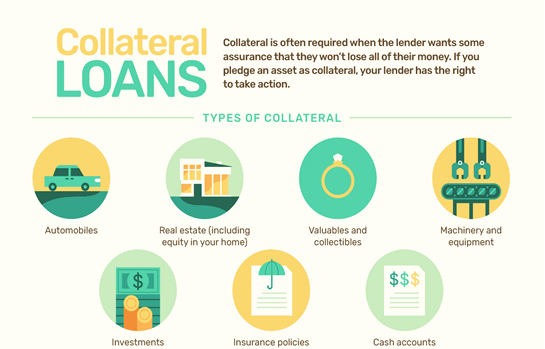

Similarly, here are other types of collateral for loans that you can provide:

Secondary property or invested in one

Most individuals buy properties for residential, commercial and investment purposes. Thus, if buying for investment purposes, it is known as a secondary property. You can use the other property with a first-charge mortgage also.

However, you must define your primary residence. You cannot have 2 primary residence properties as the main one. Instead, you can put the property from the investment purposes if not the current resident as collateral. However, in the case of a home renovation, the very property acts as collateral.

Vehicles

You can put up your car, motorbike, and other vehicles that you own as collateral to get a large amount. However, you may not get the same value, but still a better one. The vehicle should be in good condition with all the documents and proofs. Individuals with a car on finance and approaching the end may also explore the chances. It is tough, but you can check out the possibility.

Personal and business assets

Apart from vehicles, an individual and a business hold different assets. Here is what you may provide else to get a secured loan:

. Equipment/jewellery

Individual businesses taking a loan may consider taking up their own equipment. It costs more and helps you reduce liabilities on the next loan. Similarly, homeowners can provide jewellery, precious artefacts, and antiques as collateral to get the loan.

Investments like shares/bonds

Yes, some loan providers accept shares, bonds, and equities as a loan collateral. However, these are subject to market vulnerabilities and risks. Thus, the amount you may get here may vary.

Cash and financial assets

Aspects like cash in the savings account can also act as collateral for the loan. However, you may not be able to use that account until the loan ends. Apart from this, analyse the possibilities of collateralising government and public securities and Certificates of Deposit.

Intellectual property

Most business owners and startups patent their idea, also known as intellectual property. If you have something patent in your name, a trademark, or copyrights, you can use them as collateral. It is especially ideal for securing business loans with bad credit profiles.

What are the best examples of collateral?

The most obvious example of collateral is a residential mortgage. If the homeowner stops paying on the loan, the mortgage provider may rightfully claim the property. The person may launch legal action against the loan defaulter and their rights to the residential property. It thus makes one lose the property, face a financial setback, and affect the credit score.

It works completely differently from very short-term loans for emergencies online. You don’t stake your asset as collateral there. Instead, you get quick, small cash without detailed documentation, a guarantor or collateral. It helps one meet time-specific requirements without losing their assets.

The borrower here doesn’t share the chance of losing the asset. The creditor cannot tap personal assets in case of an unsecured loan if the borrower defaults on the loan. However, it may hurt the credit rating and increase the payment liability for the borrower.

Alternatively, a home equity loan is one of the best examples of a secured loan. Here, one can use the home as a second mortgage to get a loan. However, the amount of the loan should be less than the available equity on the loan.

For example, if the cost of a residential property is £3,00,000 and £170,000 remains on the primary mortgage agreement, the secondary mortgage available would be only £130,000. Thus, you can save money on interest rates and overall mortgage costs.

You don’t get this flexibility on unsecured loans. However, there you may repay the dues without stressing about losing the asset. You may also choose the repayment flexibility if you struggle to repay the dues under the agreement. You may struggle to find that option on a secured or collateral-based loan.

Bottom line

A collateral is an asset-based security that one pledges to qualify for a long-term loan with better interest rates. It is ideal for individuals with low credit scores, unemployment, and limited income. Providing collateral also reduces the monthly payments and overall amount to pay. The value of the collateral should be higher than the amount you need.