At times, you may need a financial instrument which gives you convenient access to funds. Besides, like any other borrowing arrangement, it needs you to repay on time. Up to here, it might seem like a typical loan option.

What if you can repeat the process, i.e., borrow again and repeat? This is going to solve many of those stubborn financial problems you may face. This is all about revolving credit, but up to a specified limit.

The extent to which you can borrow repeatedly will be fixed in advance. The main idea is to provide you with the flexibility to obtain money according to your necessities. Now, not always, you may need the same amount of money for a particular or different requirement.

The utility of revolving credit is not restricted like loans. You can use them multiple times by being careful to repay the dues within the specified time limit. Besides, if you pay back within a specific duration, no interest rates will be charged.

For this reason, revolving credit can turn out to be a multipurpose funding solution. Two popular forms of it are credit cards and personal lines of credit. By managing their usage and payments responsibly, you will work in favour of your credit scores.

For this reason, revolving credit can turn out to be a multipurpose funding solution. Two popular forms of it are credit cards and personal lines of credit. By managing their usage and payments responsibly, you will work in favour of your credit scores.

This financial arrangement gives you the special power to borrow money multiple times. Again, it allows you to repay the dues and take out funds for another reason. This is possible for you without getting trapped in the debt loop.

Keep exploring this blog to understand this concept in detail.

A complete overview of revolving credit and key attributes

Here, you can dive deep into its definition and everything that concerns its working to have an impact on credit scores. Revolving credit is a short-term borrowing opportunity arranged to let you get out of the grip of unplanned financial stress. You have the liberty to take out as much as you need.

It can be something that perfectly complements your financial situation. You can make the most out of it if you know how to manage and pay within the interest-free period.

Although paying in bits and pieces is allowed, avoid paying back just the minimum. It is doable for once, but not repeatedly, as the heap of debts will rise. If you have a credit card, you are already dealing with revolving credit.

This is a most popular financial tool which is now being used by almost everybody. You swipe this card to complete a few purchases. Therefore, you use the funds available on the card to pay upfront and get some rewards because of the spending.

Then, you repay them so that you can again use them for other things. Make use of this card occasionally and not for random reasons like grocery purchases regularly.

What is the impact of revolving credit on your credit scores?

This form of credit comes with credit limits. Now, the extent of funds you are taking out and utilising against the limit given determines your credit utilization ratio. If you delve deeper into studying your credit score, you will find this ratio as one of the elements.

However, you must manage the credit utilization ratio responsibly. Ideally, if this ratio remains less than 30%, you are considered safe according to the lender. It shows that you are not indulging too much in external funds.

Besides, your credit history is a representation of the way you are handling the borrowed money. If you repay on time, it will affect these scores positively and vice versa. Thus, it is up to you whether you want to create a positive or negative payment history.

This is also a critical factor in figuring out your credit scores. It portrays whether you are a responsible borrower or not. The lender will be keen on observing your financial behavior through this aspect as well.

There is another thing, i.e., the tenure of managing the credit accounts. With revolving credit option, you can keep going for years, and this will be signified by the age of the account. With a longer span of owning a credit account, you can establish that you are financially stable.

Suddenly closing the accounts should be avoided. This will create a negative impact on your credit scores by shortening the age of credit accounts.

Revolving credit combined with other forms of borrowing can represent a credit mix. This is a unique way to exhibit that you are capable of tackling different types of credits at the same time.

How is revolving credit different from loans?

You must have perceived that revolving credit is dissimilar to loans. However, you must be aware of the exact ways they differ from each other. Then, you will know when choosing the former one will be beneficial for you.

| Revolving credit | Typical loan options |

| · You can borrow time and again to utilise it as flexible funding. | · You can borrow for once up to a certain limit as defined by the lenders. |

| · Interest will be levied on the amount you will take out at that given time. | · Interest will be levied on the overall amount you will borrow. |

| · Early repayment is always possible without paying anything extra. | · Pre-payment with or without fees will depend on the lender. |

| · No guarantor will be required to help you get approved. | · A guarantor might be required if your credit scores are very low. |

| · Interest rates will start compounding if you take them out as cash. | · Late payments might lead to accruing rates of interest. |

Here, a short-term loan from a direct lender is an instalment credit. This is because you will have to repay in the form of instalments, i.e., in small portions. This pattern will be repeated over a few months till the term ends.

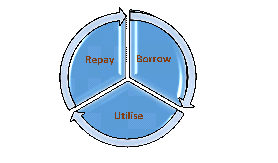

Thus, with loans, you will get to see a linear approach where you borrow and repay to end the process. With revolving credit, you will experience a cyclic pattern as you borrow, use, repay and again borrow. You will have a line of credit to access even to meet sudden expenses in the upcoming days.

What are their advantages and disadvantages?

Before going ahead to utilise this funding arrangement, acknowledge its pros and cons. Then, you will be able to weigh the opportunities and risks coming with this option. Here, you can take a look at the advantages.

1. No more stress about unexpected situations

You will at least have an arrangement in place that can offer instant access to funds. The best part is that you will have to pay interest for the amount you took out. There is no need for you to pay additional money for the credit limit you receive.

Thus, this can be a convenient option if fetching money from a monthly budget is difficult. Besides, you do not have to bother about asking for help from family or friends.

2. Build credit history

By using revolving credit, you can create a track record of timely payments. This will be helpful in building credit history from scratch. You can utilise the money to meet urgent payouts, which, if delayed, can adversely affect your credit scores.

3. Managing cash flow

This can be treated as an emergency cash buffer. However, you must be careful about maintaining its repayment. If you can take care of this aspect, you can obtain money anytime to manage issues like sudden bills, medical expenses, etc.

Because of their feasible repayment plan, you can navigate tough situations when your income may vary. With consistent efforts, you can repay when your financial condition improves.

One of the biggest disadvantages of revolving credit is its constant use can turn into a habit easily. Then, you will end up with overspending without realising the amount you have to pay back. Thus, mindful and smart use of this form of funding is necessary.

The bottom line

Do not allow balances to carry forward over months! This will pave the way for a huge and unmanageable pile of debts.